Support line breached by NZDUSDSupport line breached by NZDUSD

This trade setup on NZDUSD is formed by a period of consolidation; a period in which the price primarily moves sideways before choosing a new direction for the longer term.

This trade setup on NZDUSD is formed by a period of consolidation; a period in which the price primarily moves sideways before choosing a new direction for the longer term.

The price of USDJPY in heading back to the resistance area. It is possible that it will struggle to break through it and move back in the other direction. The

Emerging Channel Up pattern in its final wave was identified on the ASX 225 4 hour chart. After a strong bullish run, we find ASX 225 heading towards the upper

GBPUSD is heading towards a line of 1.2758. If this movement continues, the price of GBPUSD could test 1.2758 within the next 2 days. But don’t be so quick to

The movement of ASX 225 towards the resistance line of a Rising Wedge is yet another test of the line it reached numerous times in the past. This line test

Nikkei 225 is moving towards a key resistance level at 35929.0000. Nikkei 225 has previously tested this level 5 times and on each occasion it has bounced back off this

ASX 225 has broken through a support line of a Channel Up chart pattern. If this breakout holds true, we may see the price of ASX 225 testing 7773.7157 within

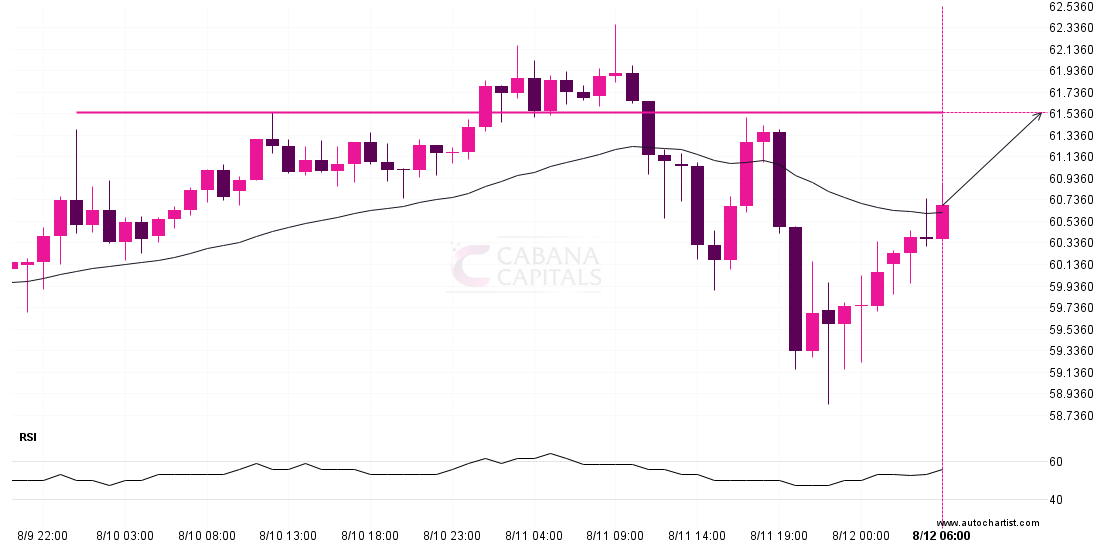

LTCUSD is heading towards 61.5500 and could reach this point within the next 12 hours. It has tested this line numerous times in the past, and this time could be

Emerging Rising Wedge detected on DAX 40 – the pattern is an emerging one and has not yet broken through support, but the price is expected to move up over

A strong resistance level has been breached at 17745.0996 on the 1 hour DAX 40 chart. Technical Analysis theory forecasts a movement to 17982.8301 in the next 20 hours. Supported