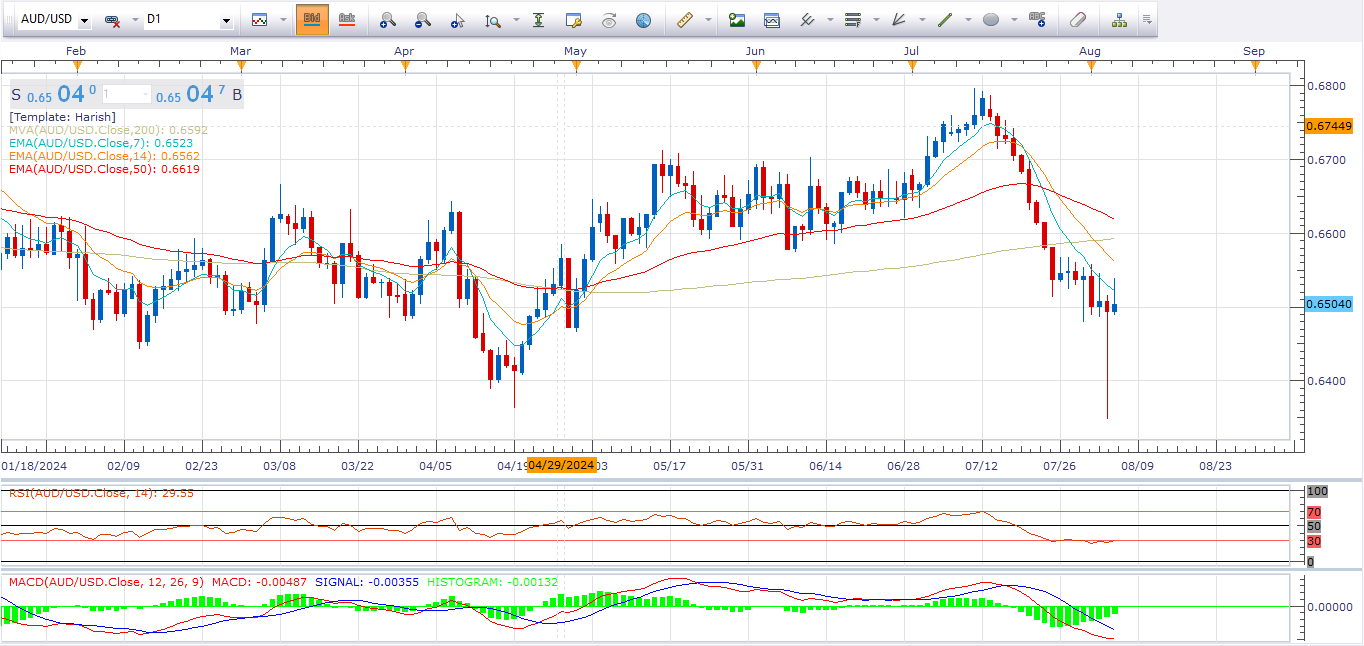

Overview: By looking at the daily chart we can see that sellers are showing their potential in the market. The market is showing downside momentum in the market. From the technical prospective, The market is previously formed shooting which cause market to fall, the swings are making successively higher highs and lower lows, In the chart hourly chart bears are showing their strong side in the market. The redback has been benefiting from robust US data pointing to accelerating job gains and also a pickup in inflation. The way bears are reacting it seems like they are approaching the 1.0190 region.

Technical Analysis: From the technical view we can see that market is going in downtrend which is providing us bearish signals level bears will get more aggressive. The pair is trading above all the major and minor EMA line which is provides us bearish signals. The odds are in favors of bears so it’s better to keep eye on the sell side. Euro/dollar is suffering from downside momentum on the four-hour chart and has dropped below the 200 Simple Moving Average. However, the Relative Strength Index is nearing the 48.16 mark, and falling below that level would put the pair in sell territory.

Recently it has breached the strong support of 1.0245 level which indicates that bears will move further downside and heading to south side. Well the next approachable target of bulls is 1.0200 level from positional point of view.

Trade Idea: based on the chart and above studies we would be recommending to our traders that go for sell below 1.0280 targets is 1.0245, 1.0205 Sl below 1.0340 wait for entry.