General overview: By looking at the daily along with hourly chart we can see that the pair hits the higher highs in the market and bulls have given us mind blowing counter attack. The USD/CHF is trading above the breakout of the downtrend line which we have received recently. The pair makes the positive momentum in the chart and creates the positive move in the market. A bullish marabuzo above the downtrend line is providing us bullish signal and we are expecting to move further upside also, pair received a strong demand pressure from the 200 SMA line which is favoring the bulls. A short-term uptrend line is also favoring the bulls.

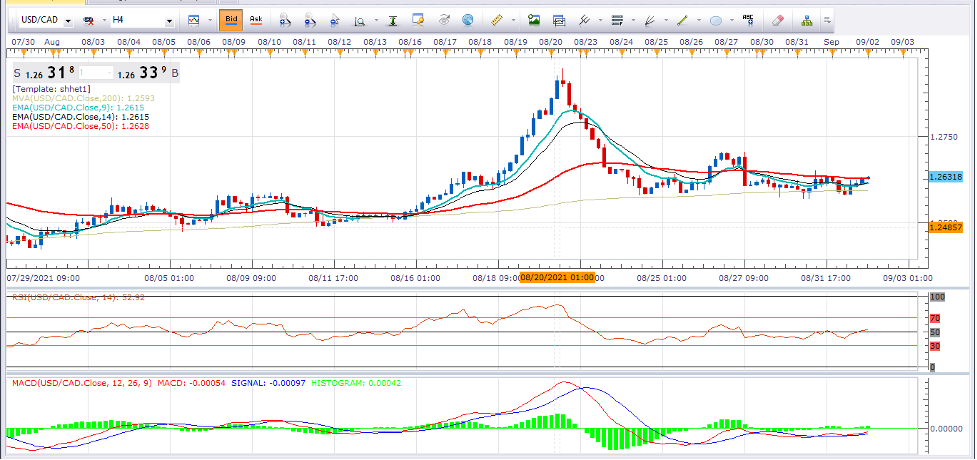

Technical overview: From the technical point of view we can say that a rounding bottom pattern is process of formation where bulls are dominating the bears and recently it has given us formation of bullish flag pattern which is posted on hourly chart and favoring the bulls. The price holds above bullish moving averages, that are finally widening their range. The RSI turned u from the oversold territory which means that the correction is over and it’s time to buy it again. So, it’s better to sit on the buy side in the market. The minor EMA lines will travel above the major SMA lines as they created the buy signals in the market. The support of the level is 1.9100 followed by 1.9000 and resistance is 1.9300 followed by 1.9350.

Trade idea : we can say traders can go for buy at level 1.9200 target will be 1.9300 and 1.9400 and stop loss is 1.9100.